The power of asset protection through a Cyprus trust

Cyprus is an island which belongs to the European Union. Located southeast in the Mediterranean Sea.

With a population of 840,000 people, this country has represented throughout history the union between three continents. Its strategic location and easy access to Europe, Africa and Asia, made it one of the favorite investment destinations in the world.

In 2004, Cyprus became a member of the EU and the Euro was established as the official currency in 2008, which increased the country´s stability and investment potential. Cyprus was a British colony in the past; therefore, it adopted a common law system.

However, a strategic location is not the only advantage that Cyprus has to offer. Besides its historic and cultural wonders, this country offers a secure friendly-business environment for those who wish to conduct business here. For this reason, Cyprus is often chosen not only for investments but also as a place where to establish residency.

Moreover, the government has actively contributed to creating favorable conditions for investors.

Mediterranean weather, beautiful beaches with pristine waters, places of historic interest recognized so by the UNESCO, cosmopolitan environment, and exquisite gastronomy, have made Cyprus one of the most prosperous countries in the UE.

While Cyprus offers many great tools such as a CBI program, companies, bank accounts, in this article we will discuss the uses and advantages of a Cyprus trust.

The trust

A trust is basically a contract between two people, in which one grants property of certain assets to the second person, in order to benefit a third party (the beneficiaries).

The trust law finds its origins in Britain and it goes back to the Crusades.

During the 12th century, under the government of the King of England, property was regarded as an indivisible entity, same as the Roman law and its continental version called civil law. Although it seemed unfair at the time to let someone with legal title hold on to a property, the King´s representative had the discretion to declare that the real owner was another person.

For this reason, when a landowner from England left to fight the Crusades, he conveyed ownership of his lands to another party so that it could manage the state, pay the feudal tribute and other duties, with the promise of recovering the title again upon his return.

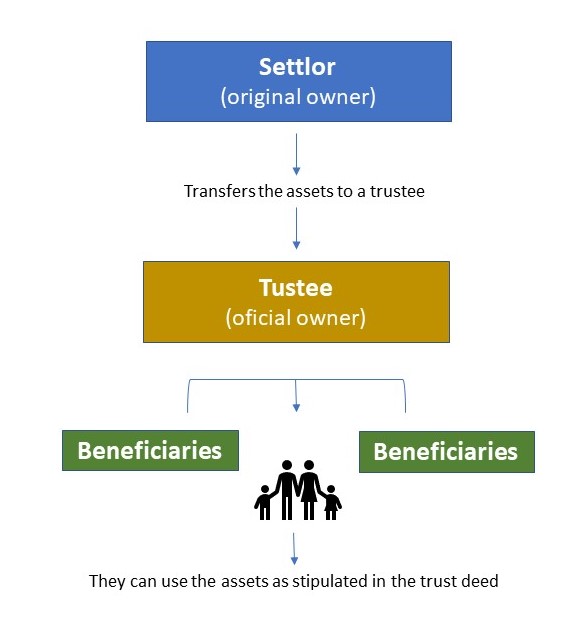

Many years have passed, and the concept of trust has evolved to a powerful asset protection tool. By handing the assets property to a trustee, then the original owner of the trust is no longer the legal owner. The trustee then owns and custodies the assets for the benefit of a third party, chosen by the trust settlor. This gives protection against law sues, creditors, inheritance problems, divorce disputes, etc.

There are some jurisdictions that offer great asset protection through trusts and today we will discuss the Cyprus trust.

What is a trust under Cypriot law?

Same as in any other jurisdiction, the Cyprus trust follows the same principles which we will illustrate with a graphic.

Trustees

The trustee can be a legal or a natural person. It will be responsible for the custody of the assets for the benefit of the beneficiaries, under certain conditions established by the settlor.

Beneficiaries

The beneficiaries are the individuals that receive the benefits from the trust. In the case of discretionary trusts, the beneficiaries can be natural or legal persons and sometimes they are not specifically named in the trust deed. Instead, the deed defines certain types of beneficiaries, for example “all current or future children of Mr. and Ms. Smith, or “charity organizations providing educational support in a particular city”.

Protectors

A Cyprus trust can also have assigned protectors, who can restrict the powers of the trustees, thus ensuring the assets will be protected and used as set out by the settlor. The designation of a protector is optional.

Trust instruments

A trust is a fiduciary relationship between two people (a settlor and a trustee), under which the former gives the latter the right to hold title to a trust asset for the benefit of the beneficiaries. The trustee has the legal title to the trust assets, while beneficiaries have beneficial or equitable title to those assets.

The main role of a trustee is to protect and manage the trust responsibly in compliance with its terms and with the country´s legislation. These terms are settled in a trust instrument called the trust deed. If a trustee ever commits a breach of trust, he or she will be personally liable for any loss or damage to the assets.

Trust asset

The trust asset is the asset or property (real estate, cash, bonds) put into the trust by the settlor.

The assets of the trust are legally under the trust´s custody, therefore a ‘break’ is created between the ‘settlor’ and the ‘beneficiaries’.

A Cyprus trust can be settled for several reasons, including:

● Asset protection;

● Wealth planning purposes;

● charity purposes;

● tax planning purposes;

● succession planning purposes.

Types of trusts in Cyprus

Fixed trusts

The fixed trust states that the beneficiaries are entitled only to the assets indicated by the settlor. The trustee is obliged to strictly follow the terms of the trust deed, having no discretion over the distribution of the assets.

Discretionary trusts

Under a discretionary trust, the trustee has discretion. The settlor allows the trustee a discretion as to the distribution of the assets. Thus, the trustee can decide, for example, the share each beneficiary shall get from the trust property.

The trustees are allowed to distribute and deal with the assets for the benefit of the beneficiaries according to their own discretion.

Accumulation and maintenance trusts

Under an accumulation and maintenance trust, the assets are kept in the trust´s custody and are distributed when certain events come to happen, e.g. when children become a certain age, when an individual gets married, etc.

The Cyprus international trusts

One of the most interesting trust structures in Cyprus is the international trust, as it offers many benefits for global investors. This Cyprus international trust is one of the most attractive trust legislations and it´s based on the English principles of equity and trust. These structures can be set up in various situations and offer many advantages that won´t be found in other jurisdictions.

Benefits of Cyprus international trust regime

The Cyprus international trust is a great tool for tax planning and asset protection, especially for high net worth individuals with complex family structures and who wish to preserve their wealth intact from tax erosion.

Benefits of the Cyprus international trust

1-Asset protection

The assets kept under an international trust are safe, depending on the circumstance, from possible risks such as creditors, lawsuits, bad divorces, etc. Because the assets no longer legally belong to the settlor, then they can´t be seized. They are now under the trustee´s custody and will be used and distributed only as stipulated in the trust deed.

2-Tax benefits

An international trust established in Cyprus enjoys all the country´s tax benefits, meaning that all dividends, royalties and interests received from the trust are not subject to tax, estate or inheritance tax, or even withholding tax. Only Cyprus sourced income is taxable, which means that, if the beneficiaries are not tax residents here, the income from the trust will be 100% tax exempted.

3-Difficult to void

It is difficult for a trust to be declared void. For such a thing to happen, the claimant would have to prove that the trust was created for the specific purpose of duping the settlor´s creditors on payment and transfer of the assets. These claims should be brought within two years after the transfer was made, otherwise the court will not even take the case.

4-Perpetuity

Following the 2012 amendment of the International Trusts Law, a Cyprus international trust is perpetual, meaning it has no time limit on the period for which it can be valid and enforceable (depending on the circumstance).

5-Confidentiality

The Cyprus international trust is subject to strict confidentiality, and any information or documentation that involves the trust can only be disclosed with a court order. All trusts should be properly registered, but the relevant trust deed does not necessarily need to be submitted.

6-Reservation of powers

The settlors have the right to revoke, vary or modify the terms of the trust and also have the right to remove the trustees or protectors, and provide instructions on how to manage the trust.

The trust settlor can specify the trust conditions in the trust deed. Both settlors and beneficiaries can become residents in Cyprus after forming the trust, or the trust can be redomiciled to another jurisdiction.

By registering a trust in Cyprus you´ll have access to many advantages such as easy registration process, limited requirements for the participants and a strong legal framework. All these advantages make the Cyprus international trust an effective tool for tax planning and asset protection.

The importance of hiring professional lawyers

In this article we cover the basic structure of the Cyprus international trust as well as other types of trusts. However, as this is a legal structure, it needs to be carefully drafted and tailored according to each person´s needs and interests. For this reason, we recommend only working with experienced lawyers that fully know the international and local trust laws.

The information presented in this article per se does not constitute a formal consultation. In order to decide what is the best trust structure for you, we recommend asking for a consultation with our partners at Mundo.

Why Cyprus

1-A growing economy

Cyprus has a strong economy and many financial tools and incentives such as invetmnet funds, a thriving shipping business and a growing real estate and tourism market. The country also has one of the few CBI programs in Europe, which attracts many investors and improves the business options.

2-Residency and citizenship options

The island of Cyprus offers great residency and citizenship options, which can be part of the asset protection plan along with a Cyprus trust. With a Cypriot passport or residency you can ejoy the benefits of conducting business in Europe and still enjoy the tax benefits of this country. You can find detailed information about the program in our citizenship section.

3-Wonderful destination

When establishing a Cyprus trust you will have connections to the country, even if you don´t apply for residency or citizenship. If you ever have to travel to the country where your trust is settled, then you can enjoy one of the best touristic places in Europe. Cyprus is the perfect mixture between beach life and culture. It has some of the best beaches in the world and a 10,000 year old culture, being a bridge between three continents (Asia, Africa and Europe).

4-Tax benefits

As we pointed out before. if you establish a trust in Cyrpus and are not a resident here, and, most importany, if your source of income is not located in Cyprus, then you are free of taxes such as withholding or inheritance tax. This would be a great choise for asset protection if you have your source of income or your assets abroad, because they won´be taxed in Cyprus where the trust is set up. However, if you plan on running a business in Europe, then the situation is entirely different.

In this case we would recommned residency or citiznehip in Cyrprus, combined with a corporate or trust structure. Thus, you will have a European passport and full access to the market as a European citizen, but will enjoy much lower rates and more incentives than in the rest of Europe, including double taxation treaties. This, of course, depends entirely on each person´s case and it should be sorted out in a private consultation.

Visit our Cyprus Country Focus page

The Cypriot trust in a nutshell

● Convenient tax regime.

● Governed by Cyprus law, protecting the trust from foreign law.

● Perpetuity.

● Unrestrained investment options.

Confidentiality: the register of a trust is not available to the general public and it only contains the name of the trust, the trustee´s name and address, and establishment date as per the current legislation.

The settlor can relocate to Cyprus after registering the trust.

Unique asset protection advantages

● An intent of defraud is required in order to invalidate the transfers.

● Not affected by succession law nor matrimonial property law.

● The creditors must prove that they were creditors at the time of the transfer.

● The statue of Elisabeth doesn´t apply.

● The UK insolvency act doesn’t apply in Cyprus.

About us

Mundo has distinguished partners in different parts of the world.

Our experts have wide experience in asset protection tools like the Cyprus international trust or the Nevis trust, and also corporate and family office services worldwide, having offices all around the world including Latin America, Europe, the Middle East and Asia.

Our goal is to provide a plan which will help our clients to create the safe structure they are looking for, in order to protect themselves and their families in times of distress and uncertainty.

Asset protection and tax optimization are important goals to keep in mind during troubled times, but the most valuable asset a person can have is freedom. Freedom of speech, freedom to travel, freedom to live in safe surroundings. Mundo works together with its partners with this philosophy in mind, and this is the basis of our practice.

Please contact us for a consultation and protect your assets for your own benefit and for the future generations.

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)

$350,000

$1,400,000

$395,000

$375,000

$165,000

What do we talk about when we mention the word “libertarian”? Concepts like this have their follower...

One of the reasons why we love Panama is its wide variety of residency options available. They are a...

Proof of source of funds is required for every financial move and also for citizenship or residency ...

At Mundo, we are on the hunt for every opportunity that can help the international investor. We love...

Do you want to incorporate a company abroad and you're still looking for the right jurisdiction? You...

Transparency is becoming more vital by the day, especially for those going global. It's no secret th...