Your family office in Singapore - escape from the US

If you read the predictions of our Mundo expert team in the Coronavirus report you would come to the inevitable conclusion that any reasonable family office should plan its escape from those countries that have demonstrated a cultural and administrative inability to cope with a crisis.

Sadly, much of Europe, South Africa, and the United States will become massive jails with increasing taxation, violence, personal unrest, and financial meltdown. The question is not whether to establish your family office but where.

Firstly, one could ask: what is a family office and why would you need one?

What is a family office?

A family office has been addressed by the Mundo Forever Free article. Briefly, a family office is a structure that takes care of a family´s entire asset protection, investment, succession, tax optimization, and governance strategy, all in one structure.

The use of a proper family office structure has protected families for over 800 years against all legal issues and problems including claims by creditors, confiscation of assets, spousal claims, taxation claims, inheritance disputes, bankruptcy, kidnapping and extortion, and indeed most other claims and issues that most people think cannot be avoided.

The way this is done is explained in our article Forever Free. Click here to read our article or contact us to receive a special brochure.

Indeed, today many families are beginning to realize that more than one family office is required in order to diversify risk.

What is clear is that every wealthy family, individual and also even those on the way to becoming wealthy, need a family office.

Many wealthy families ask their advisers where they should settle their family office. This is not always an easy question due to each personal preference, culture, and other factors to consider, but in the end, a family office should consider a number of factors.

However, a factor considered by few families is the culture of integrity of the family advisory team and governance team. What do I mean by that? Well, let me illustrate with an example: Singapore.

Why Singapore?

The story of Singapore does not need to be told because it is famous throughout the world as a symbol of what a non-corrupt government can do for its people. But let us briefly look at Singapore´s success story in order to explain the concept of integrity.

In 1960 Singapore was part of Malaysia, and thrown out as a territory in 1963, getting its independence from the British government in 1965. It is a tiny country that had no water, no military, a population in the depths of poverty, and a high crime rate. Indeed, by that time, the IMF predicted that Singapore was the least likely country in the region to succeed.

Nevertheless, Singapore, which has semi-mythical origins based on a legend of a Lion, turned to be one of Asia’s four big cats.

The Integrity of one man - Lee Kuan Yew, transformed the country in the period of one generation into a global powerhouse.

Lee Kuan Yu was famously known to have stated that when he came to power he had two choices, either to enrich himself and his friends at the expense of his people (like all governments do), or to make his people and his country greater. He chose the second which was by far the hardest, and something that almost no other leader had done.

So, while most world leaders stole the loans made to them by the IMF or diverted money for government contracts to enrich themselves and their children, Lee Kuan Yew did the impossible. He:

1. Transformed the entire education system by enrolling the top specialists and programs in the world to make Singapore the number one country for education.

2. He created a government-sponsored property ownership plan which gave 90% of Singaporeans their own house and created a real pension plan, investing in property ownership, unlike other governments that stole their people´s pensions.

3. He opened immigration to wealthy and talented foreigners with the idea that in a generation they would create a new Singaporean elite that was able to create a pool of highly skilled mobile Singaporeans in IT, high tech, medicine, and consultancy. Singapore is now one of the world’s most beautiful technically advanced cities in the world.

Singapore has also virtually eliminated violent crime by imposing the death penalty on drug related and violent crime and enforcing this strictly.

4. He invested in making Singapore the best offshore financial center in the world, creating a completely transparent low-tax system with zero tax on worldwide income, with highly skilled banking, legal and offshore support infrastructure. This propelled Singapore into the wealthiest country in Asia per capita with 18% of Singaporeans having a disposable income of over USD 1 million dollars. Now China, Latin America, Europe, and indeed the world, consider Singapore the No 1 financial center and No 1 in the global index on the ease of doing business.

But above all, the transformation was possible because Lee Kuan Yu emphasized that Singaporeans and Singapore would lead the world in an intangible quality I would call Integrity. Integrity, like pure water and air, is not noticeable until it is absent.

It is arguable that integrity became part of Singaporean culture due to the unique blend of Confucian and family values inherited from the old China, mixed with the western British democratic and governance principles inherited from the empire.

But I think few would argue that the essential catalyst or spice for this recipe was the personal example of integrity of Lee Kuan Yu and his administration. For Lee Kuan Yu and now for many Singaporeans, it would be a personal shame for themselves and their country to participate in anything where they felt dishonorable or corrupt.

In Singapore, when you appoint a lawyer, an accountant, or a manager to your board, as long as this is a genuine first-generation Singaporean raised in its values, you will likely find high integrity and it is likely that this board will run your company or family office in the same way that Lee Kuan Yu taught Singaporeans to run their country.

Most people who establish a family office, often fail to consider the value of true integrity, education, honesty and loyalty that such a concept can bring.

The absence of a culture of corruption, self-interest, and the presence of a true fiduciary culture is what is needed for an intergenerational family office to succeed. Ask yourself the importance of having a truly independent appointed adviser to help your underaged children move into their family wealth – it is in these times that integrity, like clean air, becomes priceless. It can literally mean the difference between life and death for your family office structure.

Whole books have been written about the unique values and principles of Singapore’s culture and history, and we cannot do justice to them here. Singapore is a unicorn in a cesspool of world corruption. In fact, whilst many governments, including the US, have been using the coronavirus as an excuse to lock up their people and expose them to starvation and poverty, Singapore remained open and supported its people with government loans and immediate access to the best medical services on Earth.

So, Singaporeans remained happily in coffee shops, malls, and offices and with an almost unaffected economy whilst America and Europe die of hunger on the streets.

Integrity means that Singapore is likely to thrive whilst many experts predict that the western world will drown in its own corruption and disorganization in the post corona financial meltdown with crime, disease, poverty, and government ineptitude playing major roles. Just look at Venezuela, which is the direct opposite of the Singaporean meritocracy and civilization. It is likely that very soon most countries will decay into a version of Venezuela.

If you are looking for a true Family Office where your children will eventually take over, where do you think is the safest and best place to hold intergenerational wealth?

Quick summary of 6 advantages of a Singapore’s family office

1. Singapore does not tax worldwide income so tax residency for the family means their worldwide income is not taxed and so they can legally invest worldwide. This means that Singapore has one of the best personal tax residency regimes on earth.

2. Singapore has numerous double taxation agreements and therefore tax optimization using the Singapore’s family office as tax resident is one of the best structural tools in the world. This means that Singapore has one of the most prestigious corporate tax residency regimes in the world and certainly the best in Asia.

3. Singapore Banks are cash-rich, the economy is booming, and property prices are rising, so Singapore’s economy is predicted to rise during and after the coronavirus as opposed to other economies. This means the family´s money is invested in an economy which is stable and growing and likely to do so for the next twenty years.

4. The family members have access to the best shopping, education, health, and living standards in Asia and arguably the world. Low crime and a large number of wealthy ex-pats lead to an incredibly culturally and officially rich lifestyle in an environment that has almost zero crime.

5. Singapore is a small country which is isolated from the primary threats of pandemics due to a very easily controlled border, so the major risks of a post corona meltdown are not a threat in Singapore. Singapore is also part of the Asian general economic boom next to major safety centers such as Australia.

6. The education, integrity and skill set of one of the world’s top financial centers means you have access to a high level of professionals who are knowledgeable about managing and investing money into Singapore and the greater Asia Pacific region. With such high quality regulated and insured professionals, all you need to do is relax enjoy life.

With over 2000 millionaires having invested in Singapore in the last few years, it is definitely time for you to look at Singapore as the destination of choice for your investments, immigration and family office program.

How to build a family office in Singapore?

Option 1: for those with capital up to 2 million

Very few experts realize that Singapore in fact has an existing specially created financial and legal structure for attracting family office investors. This works in the following ways:

STEP 1: If you are a family with even at least 1-2 million in financial assets, you can invest this money in a government-approved fund.

The investment can be paid into your specially established Singapore family office company, which can appoint a professional team of consultants, either on a part-time or full-time basis to run as a family office.

STEP 2: The company can establish an immigration strategy for the UBO and their family by placing the income from the invested funds as a permanent income to the UBO as the principal applicant. The balance can be paid into the family office.

STEP 3: The balance of the Family’s wealth can be managed by the Family office which can continue to invest in the thriving Singapore’s economy. Some Singapore funds are with the participation of Singapore’s government and are effectively government guaranteed.

Option 2: - for those with capital under 1 million

This option is not recommended unless you have no option because you only have less than a million to invest. In this case, you can create a company with a legitimate business purpose in Singapore which can be your family office structure. However, the company cannot simply be a passive investment vehicle but must bring genuine benefits to Singapore’s economy. If the Singapore authority accepts this, then you can be employed by your own company.

Option 1 and 2 summarized:

Singapore Employment & Investment Program (Recommended)

● Invest of US$1m / US$2M into a designated fund in Singapore for 3 years.

● Regulated by Monetary Authority of Singapore –MAS).

● Full Capital Return after 3 years.

It includes:

● Company registration.

● Due Diligence, Compliance & Screening of Officers / Shareholders.

● Government Fees

● Local Resident Director (1 year).

● Corporate SecretaryAppointment (1 Year).

● Virtual Office address (1 year).

● Bank Account Opening.

● Corporate Pass Set Up.

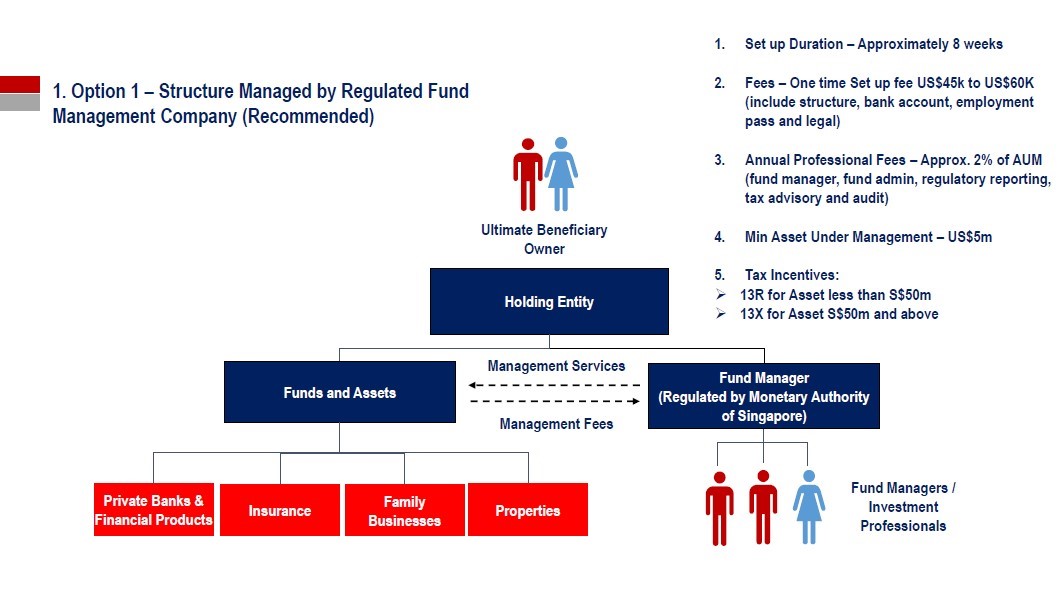

Option 3: - for those families with over 5 million wealth

With families who in fact want more control over their own wealth as a classical family office strategy, Singapore supplies the possibility of your dedicated financial management company run by Singapore professionals to invest the wealth in accordance with your desired strategy. The basic benefits of this area follow the outlined below:

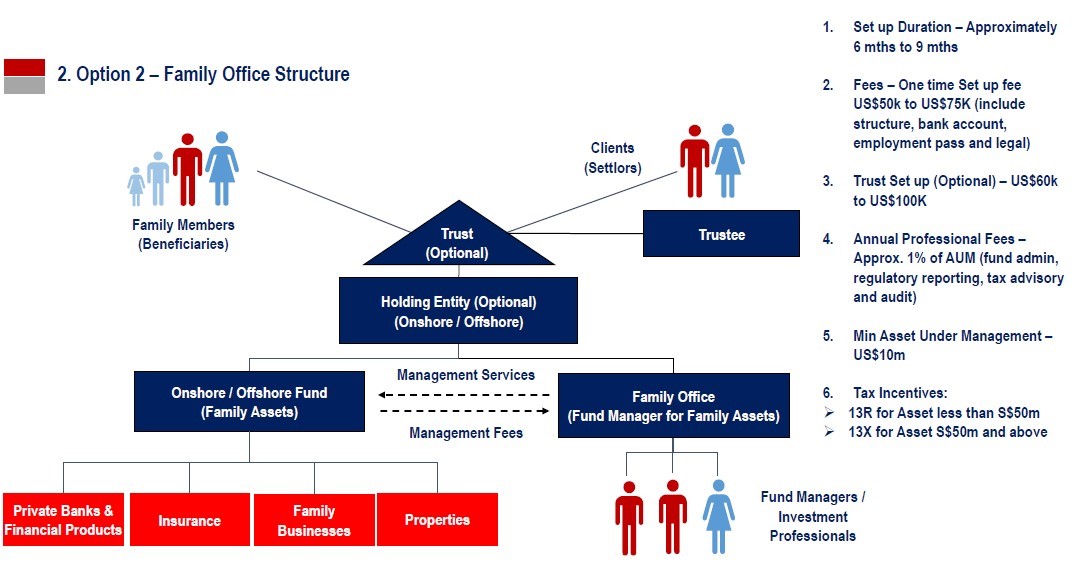

Option 4 - your own fund and fund manager - assets over 10 million

For those families wishing to have the Rolls Royce of Family Services, Singapore offers the opportunity to establish your very own fund with your very own family office fund management company. The ability to manage and control your own fund and fund manager to invest in Singapore and worldwide allows the family to develop a comprehensive financial diversification and investments strategy whilst being insulated from other funds and investment vehicles.

Disclaimer: The information contained in this article is for informational purposes only and does not constitute financial advice or recommendations. Investing in financial products or cryptocurrencies involves risks, and you should be aware of the potential risks involved before investing. The content on this website is not intended to be a solicitation or offer to buy or sell any financial products or services. The information provided does not take into account your specific investment objectives, financial situation, or needs, and should not be relied upon as a substitute for professional financial advice. You should seek independent advice from a financial advisor or other professionals before making any investment decisions. Please be aware that the legal status of cryptocurrencies and other financial products may vary in different jurisdictions and may be subject to regulation. It is your responsibility to ensure compliance with any relevant laws and regulations governing the sale and marketing of financial products and services in your jurisdiction.

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)

$350,000

$1,400,000

$395,000

$375,000

$165,000

One of the reasons why we love Panama is its wide variety of residency options available. They are a...

Proof of source of funds is required for every financial move and also for citizenship or residency ...

At Mundo, we are on the hunt for every opportunity that can help the international investor. We love...

Do you want to incorporate a company abroad and you're still looking for the right jurisdiction? You...

Transparency is becoming more vital by the day, especially for those going global. It's no secret th...

Where is Seychelles and what can I do here? If you haven’t heard about this jurisdiction yet, then i...